For many cryptocurrency is synonymous for freedom. Besides being a decentralized currency that exist outside of the current financial system gives holders more options. The returns on crypto currency investment are near impossible in traditional finance especially with crypto staking projects.

It’s normal for a crypto to jump by double percentages in a day or even a single hour. While bitcoin has seen this sort of action over its history, many of you all know that these impressive gains are much more commonly seen in all kinds of smaller market caps.

However, the holy grail of crypto market investing is finding early alt coin projects well before they make it to the large trading platforms. Returns on newly listed crypto currencies can easily be one hundred X or more with the highest reported return on an a crypto ICO has been reported at one point three million 1.3m percent.

One of the Shiba Inu (CRYPTO:SHIB) wins as best investment vehicle of 2021, hands down. It’s mind-blowing gains over the past year may have propelled some investors into millionaire status, even as its real-world use remains questionable. If you’d invested just $100, depending on when, you might be set for life. Let’s dive in.

As speculative as it gets

Investors who bought Shiba Inu at the beginning of 2021 likely didn’t see what was coming. I don’t think anyone anticipates a 53,241,775% one-year increase in their wildest dreams. If you’d invested $100 in Shiba Inu exactly a year ago, you’d have more than $53 million. And the price is down from its October highs; if you’d sold then, you’d be even richer.

At the beginning of 2021, there were more than 4,500 tokens on the crypto market. That rose to nearly 8,000 by November, and a total market cap of nearly $2 trillion just for the top-10 traded coins. And it’s not only the top tokens that have huge market caps. Although none comes close to Bitcoin‘s nearly $1 trillion, even those way down on the list are seeing heavy volume. Strike, No. 400 in terms of crypto market cap, has more than $117 million in market cap, and more than $16 million trades hands in a 24-hour period.

Theoretically, any one of these coins (or more than one) can see astronomical gains. Many of them have, even if not quite at the level of Shiba Inu. But unless you see real utility from the crypto investment of your choice, it may just be a guessing game as to which of the thousands out there will be the next Shiba Inu. Strike, for example, lost 44% over the past year. Streamr, No. 455 in crypto market cap (yes, I picked these randomly), has a $91 million market cap and gained 216% over the past year.

Finding the right early stage is no easy task but by the end of this video you will have everything you need projects that may change your life forever. Before I begin the banter I need to come clean now I hate to disappoint you but I am not a financial advisor and so nothing in this article should be considered a financial or investment advice consider this article to be a valuable resource you can use to further your refine your understanding of the crypto space.

My vision of cmgcrypto.com is to investigate the greatest crypto currency exchanges and defy protocols and then give you no nonsense break downs of what I find and most of the moves I make on this website.

There are two things you shall always keep in mind when you are evaluating an upcoming crypto currency these are Fair Launch and Premine. Fair Launch crypto currency are those that do not have any specific allocation and are earned by the people who actively participate on that crypto currency block chain.

The most famous fair Launch crypto currency is of course Bitcoin. Bitcoin began when it’s genesis block was mined in 2009 it created the first fifty CTC which went directly to the person who mined it bitcoin creator xx(2:45 (name).

As time went on and more people started mining bitcoin the distribution of CTC increased along with decentralization and security of bitcoin network no BTC was premine none of it was automatically allocated to any investors in the project and one hundred percent of the mining reward went and continue to go the people who participate in the bitcoin network as miners.

Other examples of fair launch crypto currency include Mine coin Dutch coin and more recently the Wi-Fi token one hundred percent of which was earned by those providing liquidity on various pools of earn. com finance. This is in short contrast to most crypto currency we see today which had something called a premium as the name suggest.

Premium cryptocurrencies usually have a portion of their initial total and sometimes even future supply pre allocated to certain groups of people these includes private investor, founders and non-profit organizations of the same name those who participated in the public ICO and those who activitely participates in the cryptocurrency network assuming it provides mining or staking.

Now since premium often involve allocating a large number of tokens to a small group of individuals and entities that have the same profit motives as you and me then certain behaviours can and often does suppress price action. The worst examples of this are from the XRP and Stella neither of which have mining rewards and decentralization and both of which healthy and overwhelming majority of their initial totally supplies when they launch.

Ripple in particular has come under fire many times for selling large amount of XRP with that said premine crypto currency are not always bad they just are associates with a higher risk of collapsing financially or programmatically due to a higher degree of centralization and inequitable token distribution.

Likewise fair launch crypto currency aren’t always good if they have a bad token on it , it can make it very hard to see any serious price action although most all new crypto currency you see premium be on the lookout for any fair launch crypto currency they are incredible rare and hard to find but will likely yield much higher rewards than premium cryptos. The best place to fish for fair launch cryptos are place like Twitter, Reddit and Bitcoin talk. Sometimes the crypto media will also cover a fair launch crypto if it was created by a notable personality in space for all the others you will have to get down and dirty and fine the good premine cryptos using an ICO tracking website.

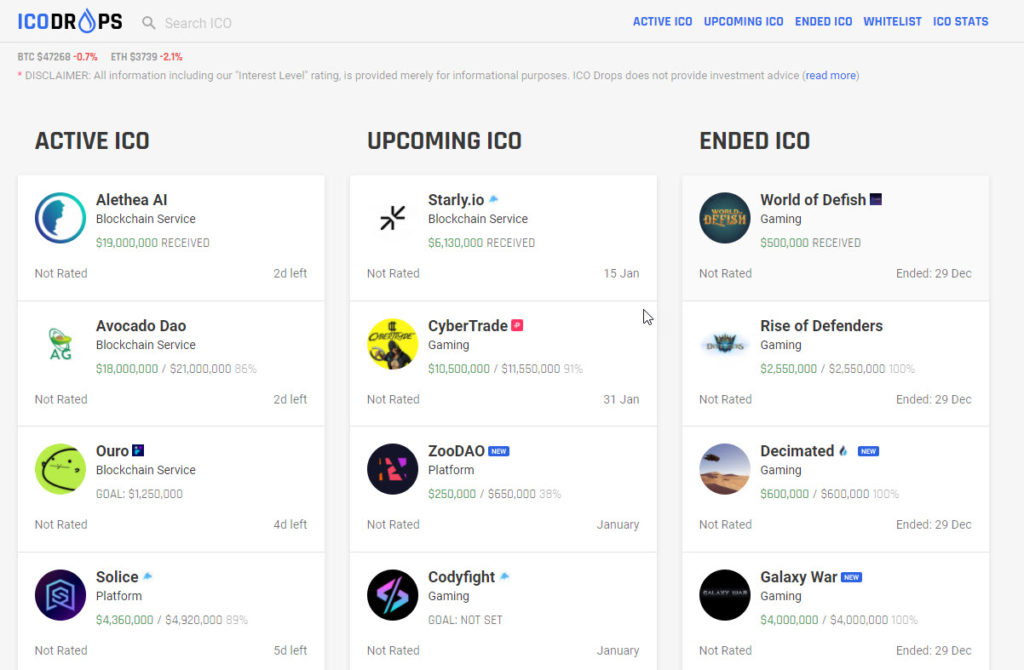

While there are many ICO tracking websites the best is probably ICO drops on the home page you will find three columns. The two that concern you are Active ICO and Upcoming ICO. Here you will be given a list of a few dozen currencies luckily ICO drops provides a short summary of each ICO when you click on them.

If this summary is incredibly vague or sounds identical to crypto , bitcoin or interium you are probably dealing with a grade a ship coin, by contrast projects that have an explicit use case that is not being address by the exiting crypto or even seek to add value to bitcoin or etherium can have serious potential.

To be sure there are a few more things to check if you scroll down just a bit you will see a few critical details about the action token sales but the first thing you need to do is to make sure you can actually allowed to participate in the sale at all a list of the exempt countries is given on the right hand side, I would also encourage you to study the local laws in your country that pertain to these projects just because they are accepting your investments does not mean that they are legally allowed to.

Anyways the second thing is to take notes of the prize token at ICO the lower the price the bigger the game assuming that everything goes according to plan of course. The third thing to check is whether the tokens being sold are actually token or tokens issued on the projects native block chain. You can consider this to be a dichotomy similar to premine and fair launch.

If you see an ICO pre distributing tokens this is generally a good sign because it suggest that the project put in the work to create a functioning project or platform, by contrast it takes very little effort to create and only cost a few thousand dollars to build a cheap website hire someone to write a white paper filled with buzz words and buy some publicity in play to play news add the result is a crypto currencies that looks good on paper but has no and perhaps even no true intention of delivering on the promise made on the onset.

This happened hundreds of times during the ICO boom 2017, 2018 and unfortunately continues to happen even on to this day there is one exception to this though and that is when evaluating some promising defy launches these projects issue 2020 especially if they want to interact with xx and its small contracts. If you continue scrolling down the page of the ICO you selected you will that ICO drops has continue taking a few screen shots which will show you things like the token allocation any large investors in the projects any note able partnerships and sometimes even the road map.

These images on ICO drops can also be really useful when evaluating crypto currency when already on the market because in many cases the information is no longer available on the website of crypto currency. I personal do this as part of my research of existing crypto currency projects.

A good rule of thumb to follow here when analyzing any partnership when you buy crypto currency project is to assume the most of them are weak or entirely nonexistent until proven otherwise. Sometimes a partnership with Google just means that the people working on that crypto company use Gmail. The easiest way to fast check is to go and poke around that crypto project blog or medium page if you cannot find a blog post that detail the specific nature of the partnership consider that a red flag.

Similarly, any claims that feature them in reputable outlets like Forbes or CNN are usually nothing more than paid crypto currency news sites like coin telegraph clearly label the sponsored posts others not so much verifying whether a reputable venture capital firm has invested in the project is likewise important but can be a bit more difficult to do you can again check the ICO blog or medium to try and find details but you probably have more luck checking a website like crunch base.

Most crypto currency projects are listed on crunch base manner and you are often able to see how much seed money was raised by that crypto project and where it came from. Crunch base also usually provides sources for these amounts. Here is where things get a little bit tricky.

While it was always nice to see the crypto project got millions of dollars in funding from reputable venture capital firms that money will have some strings attached to it, exactly how many strings attached to that capital is partially revealed distribution of the project. More often or not ICO drops will provide images detailing token and allocations for past and present and future currency ICO’s.

Ideally majority of the initial token supply should be sold during the ICO but this is almost never the case. It is more common to se ICO allocations of anywhere between fifteen to fifty percent of the initial token supply, if less than fifteen percent of the initial token supply is going to be publically sold I would think twice about investing in this ICO.

With that said this will all depend on whether or not these tokens will have block out or investing schedules in other words whether the tokens are allocated to investors funders and other investors will have and other non ICO purposes will be immediately available or if they will gradually be released over a fixed period of time. unfortunately, the images of ICO drops provides is not always provides details of these vesting schedules if this is the case you are going to have to do some digging.

To kill two birds with one stone also be on the lookout for any details related to token supply token or token burning which are also not provided by the ICO drops. The first resource you should check is the crypto currency website if you are lucky they will have a page dedicated to their token which details any block out periods or vesting schedules.

The second resources are their blogs or media pages and what you are looking for is a post which goes into detail about the token. The third resource you should consult is that projects white paper which should also be somewhere on their site you can either scroll to the section which details the token or search the document using keywords like allocation vesting block mining reward, inflation supply burn and mint.

The ideal token would be a gradual unlock for all ICO token but at least two years or more and a maximum supply or annual inflation with bonus points if the token is deflationary. Most important if a token must provide robust economic incentives for participation either due to reduce case or staking or mining rewards.

If you have gotten this far and still don’t have a clear picture of this ICO token lock ups vesting schedules or inflation I would personally call it quits. When an upcoming crypto currency does not provide upfront to investors to me that’s a deal breaker. However, if you are convinced that it could still be an investment opportunity here is your last course of action should be to reach out to the team directly using that crypto projects skip hub or telegram channel.

Again, you will usually find the links to this somewhere on that projects website assuming that you have made it this far and everything checks out you now need to evaluate the hype around the project. In addition to strong fundamentals partnership token and upcoming plans that must be able to generate the hype that’s need to get people interested and engaged.

This is because at the end of the day the thing that is going to propel the price of any given asset is high demand. There are many ways you can measure the demand for a crypto currency is ICO stage if the ICO you are currently interested in on the way easily see if the demand is high by how much the project is raised relatively how long the ICO is active if it has only been a day and the project is already fifty percent funded you might have a winner on your hands.

However, the real moon shot ICO tend to sell out within hours or even within minutes meaning you are going to measure the demand well before these start flying. If the ICO you are interested in as yet to occur go to the website and open up all of their social channels twitter telegram face book medium you name it.

If they already have thousands of followers and have a high amount of engagement you can be pretty confident that their ICO is going to do quite well. The real combo breaker is if the crypto currency project also has some amount of star power this includes thing like having a reputable or popular founders, having any significant partnerships or if the project is working closely with a current leader in the present crypto currency space.

This is important because as the ICO approaches explaining the object and other crypto currency is going to become less and less important. Picture this you have two crypto currency projects in their ICO stage let’s call them A&B both have good fundamentals token economics use cases the whole shebang.

However, A has star power where as B does not it’s hours before the ICO crypto power project B last minute investors flock to the project to see if they are going to invest. Since they didn’t do any actual research they see what they are going off is what they see on B’s social media, so they see a whole bunch of cool but complicated info graphics statistic and a bunch of other stuff that seems logical and a few of them invest in the ICO.

Its hours before the ICO and crypto project A and last minute which is once again flock to the project since they once again did not do any actual research they are going to make decision based on what they see on that crypto project social media they see names of companies like Google and Microsoft they see pictures flaunting some handsome Harvard educated block chain wizard with a solid name like “I don’t know “dude and perhaps a photo of said handsome guy shaking hands with (xx name 15.54).

Almost every single last-minute investor instantly participates in ICO and some even forecast this amazing opportunity on their own social media channel brining even more investors into the project now these irrational investors brought in it is only a matter of time before they become hope mites and it is only a matter of time before they become more level headed investors who actually did their research and made their way in the project with a rational mentality in the first place.

There is one last very important thing I need to cover and that’s the difference between ICO’s IEO and IDEX offerings, although all three are a mean of selling a cut of crypto currence supply they all have different implications on price action.

In my book an ICO occurs when tokens are directly transferred from the crypto project to investors who participated in the sale sometimes it happens on the same day but usually this takes place sometimes after the ICO is ended. The problem is the tokens issued during this manner do not usually list and any reputable exchanges right away as such a lot of the initial price action can be nothing more than market manipulation.

If the token issued during the ICO isn’t RC token it will often end up on uniswap this is good but far from ideal these tokens far from reach from idly use centralized exchanges. If the bull market continues in the direction it is going and retail investors come rushing in and they won’t be going to uniswap to buy that token and that’s bad news for you.

On the flip side not being immediately listed on any reputable exchanges mean a token can stand benefits if and when those listed token enhancements do come out enhancement that the token will list on finance on coin base are probably the best opportunities to sell the top when the hype comes in and buy the when the price goes down shortly after listing.

Tokens issued during IEO do not have these benefits but are instead lest with the perk of being immediately available to inexperience and irrational retail investors who push the token to the moon if it starts to get momentum. The issue is that IEO tend to sell out quickly tend to have a lot more requirements than ICO for investors and volatility also tend to be incredibility high in the first two days or even weeks after the IEO ends.

Finally. we have IDEX offerings which is when you use a decentralize exchange to buy newly issued tokens. IDEX has no offering requirement since anyone with an internet connection can use IDEX not surprisingly many IDEX offerings ended up as being scams referred to as rug pools which is when crypto project issues the tokens and then runs off with the people invested and leaves them useless ERC token

IDEX offerings also tends to be much more expensive for investors due to heath gas fees that need to be paid to use IDEX these gas fees are incredible high and needs to be if you want for investors consequently the action paid for tokens ends up in much higher than the initial price which is by the crypto project and it’s therefore the common price you bought to crash significantly in the days follow.

This can actually lead to the total collapse of the price keep those things in mind when investing in ICO and EO’s IDEX offerings and there you have it your very own step by step guide and how to pick the next hottest crypto currency before it even hits the market.

If you are lucky you will stumble upon crypto came into being by a fair launch like bitcoin realistically though you are going to spend bit of a time from the bad premine cryptos using an ICO tracking site like ICO drops is a good place to scout out current and future ICO these sites tend to provide short and concise definitions of what the project is all about and let you know if you are eligible to participate.

They will also tell you whether the token is being sold on native tokens or new crypto currency or ERC tokens that are sometimes that are backed by nothing more than promises. Figuring out whether a crypto project will keep its promises partially depends on who is backing it seed money from reputably venture capital firms and tangible partnership with big names inside and outside of the crypto space are signs that you are dealing with a promising project but it also means that you aren’t going to be the only investor with their hand in honey pot.

Token allocations tend to screw towards the project founders team investors and various other purposes leaving a small piece of the pie for those who actually participate in ICO. Whether or not this is a bad thing depends on whether or not there is a look up period or vesting for those none ICO tokens.

This can be easily checked using images provided by ICO drops along with the crypto currency projects blog and documentation. This documentation can also be used to answer any question relating to inflation deflation supply counts and any other supply that could influence the price of the token’s future.

Once you confirmed and ICO meets your standard metrics estimating the demand for that ICO by checking social media activity and any star power will give you the final conformation on whether or not it’s worth investing in, and finally be aware of the different price trends typically experience by token sold in ICO IEO and IDEX offerings.

While there are more effective in the short term there can be to make or break crypto project during this bull run