CELCIUS UPDATE 10/6/2022

Celsius execs withdrew $56m |

| Celsius Network’s three top executives withdrew $56 million in crypto — weeks before the company froze customer accounts, court documents have revealed. New filings show Alex Mashinsky, Daniel Leon and Nuke Goldstein claimed Bitcoin, Ether, USD Coin and Celsius tokens worth millions of dollars. Mashinsky stepped down as Celsius CEO last week after a number of customers called for him to step down. It’s now emerged that Leon — the bankrupt crypto lender’s co-founder and chief strategy officer — has also resigned. All of this will raise questions about whether the executives knew Celsius was in financial jeopardy at the time of these transactions. An estimated 300,000 customers have a balance of more than $100. |

CELCIUS UPDATE 7/19/22

Celsius Network’s Restructuring Steps Revealed

Source: Tom’s Hardware

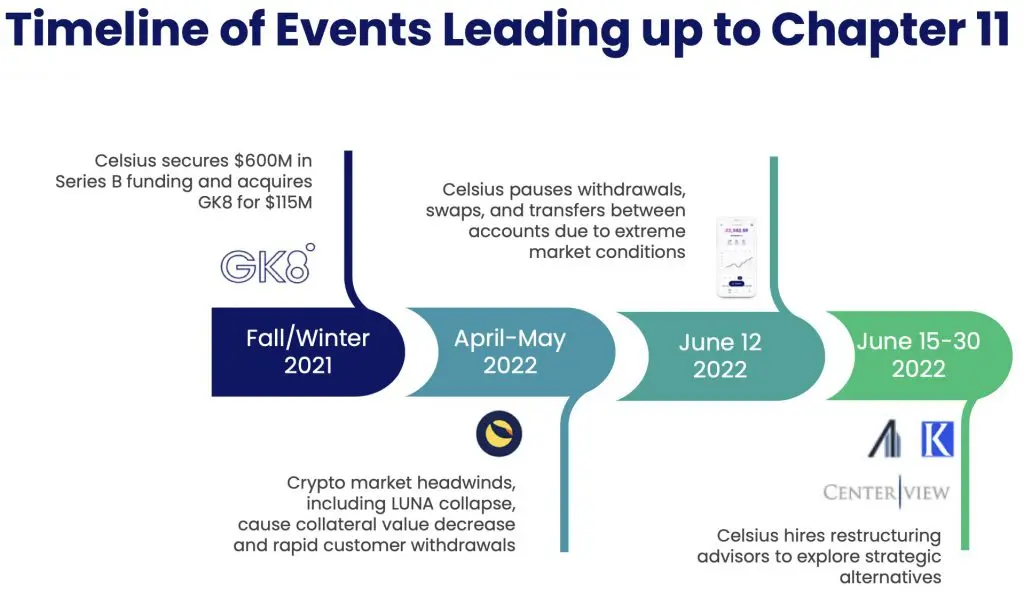

Celsius Network was the latest crypto firm to face the brunt of the ongoing crypto winter. The firm and its mining unit have recently filed for chapter 11 bankruptcy, and this came moments after the company paid its debts to Compound and Maker and cleared its Bitcoin loans earlier this month.

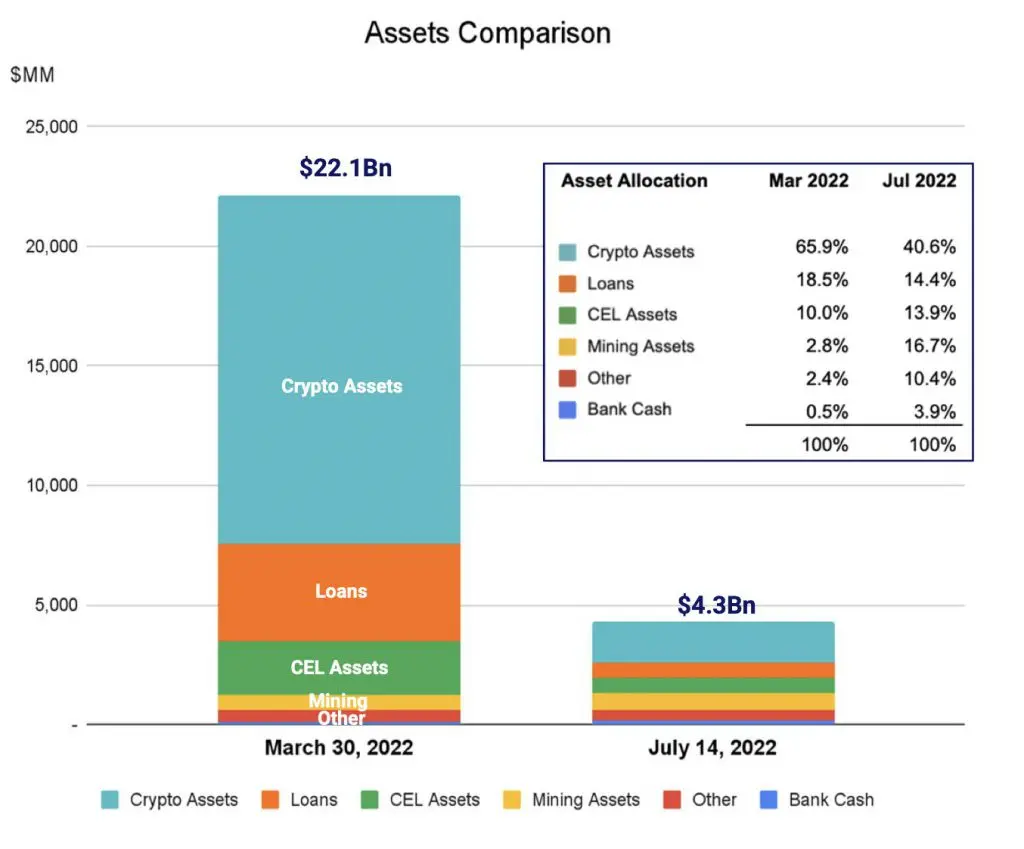

Nonetheless, the bankruptcy was a way for the company to protect itself while strategizing a restructuring plan. As revealed by the filing documents, Celsius had liabilities of $5.5 billion. Of this, a majority is owed to their customers, amounting to a whopping $4.7 billion.

However, the firm has revealed its restructuring plans in light of its court hearing.

Celsius Network’s Protective steps

The company has revealed that it has broken away from most positions where it borrowed and posted collateral to a third party. They also revealed most of the keys to their crypto assets are stored on Fireblocks, and the firm is not relying on intermediaries to hold their keys.

Additionally, Celsius has halted new loans, coin swaps, and coin transfers among customers. They have also frozen loan accounts and have stopped liquidating any loans. Moreover, the firm has suspended any new investment activity, including staking assets on other protocols.

Restructuring Steps ahead

Besides the steps taken above, Celsius has also revealed its plans to restructure the company.

Now, although Celsius’s mining unit has also filed for bankruptcy, it is still operational. Of the nearly 80,000 mining rigs under Celsius, ~43,000 are still running. The company plans to use Bitcoin from its mining activities to repay its debts.

The company is also considering asset sales and third-party investment opportunities. Now, the mining rigs are also a part of their assets, and selling those can impact the already falling mining rig prices.

Lastly, the firm may provide customers with the option to recover cash at a discount or remain long on crypto. This seems like a harsh option, and many will not be pleased with the same.

Regardless, Celsius is in a tight spot. The firm will have to go out of its way to regain the trust of its customers. Time will tell how things pan out for the company. Pulling out of the winter could give the company a much-needed break.

Become your own Bank with Celsius (Earn up to 17% APR) Those days are over??

The U.S. Securities and Exchange Commission is scrutinizing cryptocurrency firms Celsius Network, Voyager Digital Ltd. and Gemini Trust Co. as part of a broad inquiry into companies that pay interest on virtual token deposits, according to people familiar with the matter. Banks and traditional financial institutions are scared of the high annual percentage rates that are being offered by crypto companies and don’t know quite what to do about it.

The SEC enforcement review focuses on whether the companies’ offerings should be registered as securities with the watchdog, said the people, who weren’t authorized to speak publicly. The firms are able to pay customers rates higher than most bank savings accounts by lending out their digital coins to other investors, a practice that the SEC and states including New Jersey and Texas have said raises concerns about investor protection. However many investors feel they should have a free choice and where and how they choose to invest their money.

The probes add to uncertainty for the burgeoning sector, which is grappling with sharply falling coin prices — Bitcoin earlier this month plunged 50% from an all-time high — as well as regulators who are eager to put guardrails around digital assets. BlockFi Inc are-the-8-yields-offered-by-blockfi-financial-too-good-to-be-true/., another crypto lender, faces SEC scrutiny, Bloomberg reported last year, and both Celsius and BlockFi have been the subjects of earlier enforcement actions by state securities regulators. Those reviews are ongoing, and the firms have disputed the allegations.

Read More: BlockFi Faces SEC Scrutiny Over High-Yield Crypto Accounts Look to Clean Up Crypto PowerLawmakers Look to Clean Up Crypto Power

“We are one of many companies the SEC has reached out to regarding crypto yield products,” Gemini spokeswoman Carolyn Vadino said in a statement. “We are cooperating voluntarily with this industry-wide inquiry.”https://384b0dba316fe50bb30b9280336b5b6f.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

“All discussions with regulators are confidential,” said Bethany Davis, a spokeswoman for Celsius. “We always have, and will continue to, work with regulators in the U.S. and globally to operate in full compliance with the law.” while providing our customers the highest returns possible.

The regulatory environment is evolving rapidly and “it’s normal for financial services companies, digital asset related or otherwise, to be in ongoing dialog with regulators,” Voyager spokesman Mike Legg said.

The SEC hasn’t accused Gemini, Celsius or Voyager of any wrongdoing and not all agency queries lead to enforcement actions. An SEC spokeswoman declined to comment. Bitcoin. Blockchain. Web3.Make sense of it all with our new crypto newsletter.EmailSign UpBy submitting my information, I agree to the Privacy Policy and Terms of Service

and Terms of Service and to receive offers and promotions from Bloomberg.

and to receive offers and promotions from Bloomberg.

Crypto lenders say they’ve collected more than $40 billion in deposits. The accounts look a lot like traditional banking, where firms take deposits and pay interest. The difference is these firms offer rates on many tokens of 3% to as high as 18%, paid in digital coins, compared to the average bank savings account that yields 0.06%. Unlike bank deposits, the crypto accounts aren’t federally insured, meaning it is possible for investors can lose their principal.

https://384b0dba316fe50bb30b9280336b5b6f.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

The companies generally say they make money by lending out the crypto at even higher rates to institutional investors, who need the tokens to execute their own trades. But since the firms don’t register their products with authorities, regulators have said they worry that potential risks aren’t disclosed to investors.

Celsius, which has $18.1 billion in deposits, incorporated in the U.K. in 2018 but last year said it would move its headquarters to the U.S. amid regulatory uncertainty. The private company recently raised money from investors including Caisse de Dépôt et Placement du Québec, Canada’s second-largest pension fund, valuing Celsius at more than $3 billion..

Gemini’s crypto exchange was launched in 2015 by Cameron and Tyler Winklevoss, the twins who famously feuded with Mark Zuckerberg over the founding of Meta Platform Inc.’s Facebook. The firm’s “Gemini Earn” crypto accounts pay interest of as much as 8.05%, which the firm says it earns by partnering with third party borrowers whose risk it vets.

New York-based Voyager, which also runs an exchange and had $7 billion in assets under management in November, is listed on the Toronto Stock Exchange and had a market value of about C$1.7 billion ($1.35 billion) as of mid-day Wednesday.

The SEC last year sent Coinbase Global Inc. a letter warning the company would be sued if it moved forward with a lending product, and the company later tabled its plans. Chair Gary Gensler has repeatedly said he believes many crypto firms are selling products that should be registered with the agency — and has urged firms to come speak with the watchdog about how they should be regulated.

State officials, including those in New Jersey, Texas, Alabama, Vermont, Kentucky and Washington, have brought several enforcement actions against Celsius, BlockFi or both and threatened to ban them from doing business. Regulators in some of those states are now also considering taking similar action against Voyager, according to people familiar with the matter. It’s normal for companies to be in ongoing dialog with their regulators, Voyager’s Legg said.