UPDATE 4-21-2-23

NFT ACTIVITY IS TRENDING DOWN

2022 was a rough year for NFTs. And so far, 2023 has been worse. While Bitcoin has started 2023 off with a bang, other niches within the crypto space are lagging.

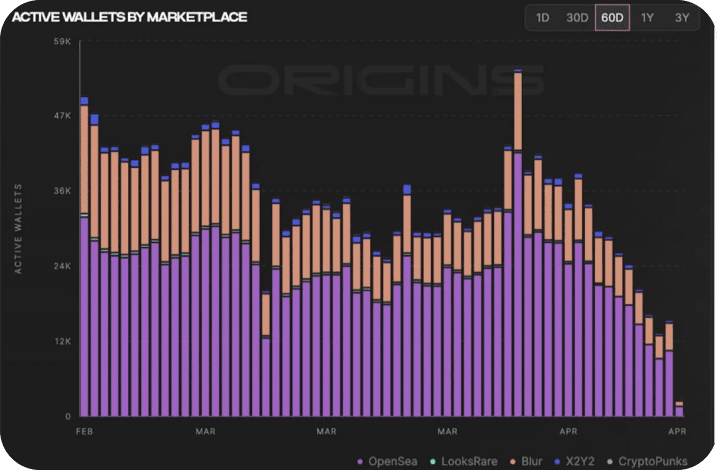

NFT market metrics are down bad. One tracks the number of active wallets engaging with NFTs each day. And it just fell off a cliff.

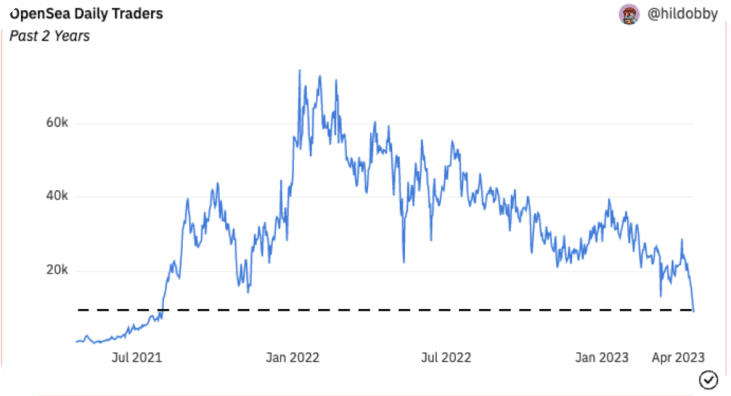

When you narrow it down to the most popular NFT marketplace, OpenSea, things look even worse. OpenSea hasn’t seen so few daily users on its platform since July 2021.

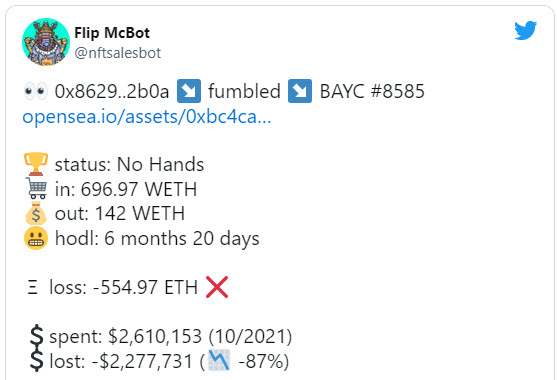

No one is safe. The top collection on OpenSea is way off its all-time highs: The cheapest Bored Ape Yacht Club NFT has gone from $422K → $76K.

has gone from $422K → $76K.

And to add to the pain, a lot of past NFT volume was due to wash trading , where the same user trades an asset back and forth. It’s estimated that more than half of all NFT volume was wash-traded in 2022.

, where the same user trades an asset back and forth. It’s estimated that more than half of all NFT volume was wash-traded in 2022.

Why does this matter? It shows things are a-changin’ in NFT land.

When NFTs got popular, it was all about momentum. People were always chasing the next shiny object and throwing money everywhere they could.

Remember when Pixelmon (NFT project) was able to raise $70M off just an idea?

off just an idea?

But now, times have changed. Starbucks, Reddit, and Nike are all taking different approaches to their new projects, ones that customers are actually digging.

They’re putting their focus on low costs, wide access, and deeper relationships with consumers. In my mind that has always been the real upside value of NFT’s. Move over cartoon Jpegs.

Even Blue-chip Ethereum NFTs are feeling the downward Pressure.

- With lower ETH prices, floor prices of blue chip NFT collections are going down

- NFT trading volumes have also dropped to their lowest monthly levels

The current cryptocurrency downtrend has prices plunging across the board — and with the value of crypto falling, so have NFTs in dollar terms been declining over the past few weeks.

Ethereum (ETH), the leader of the NFT market, is trading around $2,000 at the time of publication, down from $2,800 a week ago. Terra’s stablecoin, TerraUSD (UST), and its native token, LUNA, collapsed in recent days, losing more than 99%.

While UST de-pegged from its one-to-one tandem with the US dollar and is trading at $0.13, LUNA hovered around $0.0000914 Friday afternoon.

NFTs built on Terra, meanwhile, marked record levels of trading activity on May 11 that have since declined.

Ether’s lower prices, on the other hand, have caused a lingering drop in ETH NFT floor prices, along with lower gas fees (which power transactions on the ethereum blockchain).

Blue-chip projects, such as Bored Ape Yacht Club (BAYC) and CryptoPunks, have been no exception. Trading of Bored Ape Yacht Club collectibles on OpenSea fell to its lowest point in the past month, down 63% on May 12 over a seven-day period.

While the range of daily sales has fluctuated between eight and 67 NFTs on any given day since the beginning of May, the collection’s floor price has taken a more consistent hit.

It dropped to 89 ETH ($169,792) on May 12 and went back up to 99 eth Friday as markets showed signs of stabilizing. BAYC’s floor price peaked at 152 ETH and nearly crashed the Ethereum network on the eve of the debut of Yuga Labs’ Otherdeed for Otherside collection in early May.

Otherdeed NFTs — required to purchase land in the Otherside metaverse — remain in the top 10 collections with the highest trading volume since its debut on OpenSea. It ranks alongside its parent company’s other collections like BAYC and Mutant Ape Yacht Club in that respect.

Otherdeed for Otherside’s transactions have declined precipitously since launch, from $375 million in volume to $6.5 million, according to NFTGo. Even so, the collection has recorded some of the highest priced NFTs this week, according

to NFTGo. Even so, the collection has recorded some of the highest priced NFTs this week, according to NonFungible.com.

to NonFungible.com.

Otherdeed for Otherside #59906 sold for 625 ETH, equivalent to $1.6 million.

Other NFT collections that continue to lead the charts this past week include Art Blocks, Doodles, Moonbirds and Azuki and Beanz collections, even after its founder revealed he was part of three previously failed NFT projects .

.

Market conditions have also prompted some NFT investors to try to liquidate their holdings, amid considerable losses

In other NFT news, Meta began testing an NFT display feature for a select group of Instagram creators and collectors earlier this week. Once the function becomes publicly available, it could potentially affect the greater NFT market.

for a select group of Instagram creators and collectors earlier this week. Once the function becomes publicly available, it could potentially affect the greater NFT market.